最高のコレクション yield formula excel redemption 279831-Yield formula excel redemption

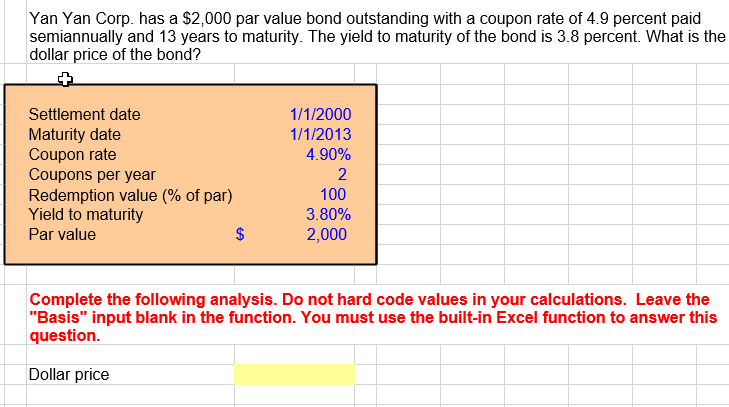

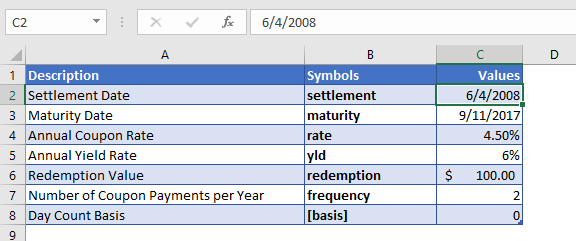

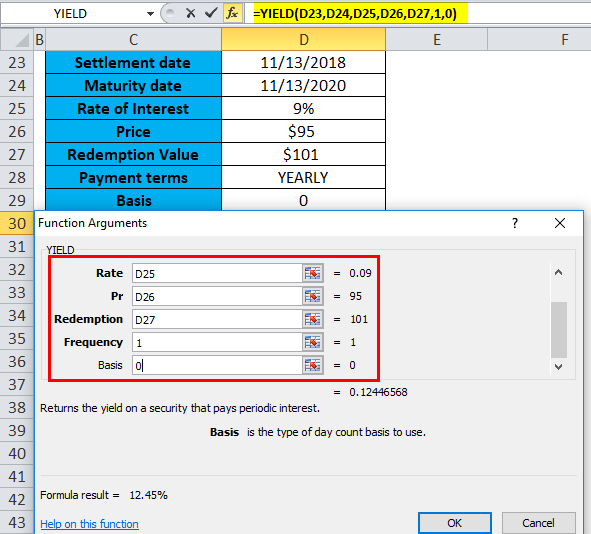

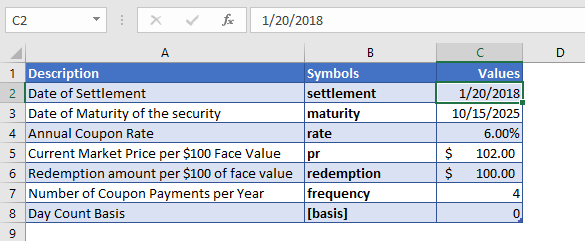

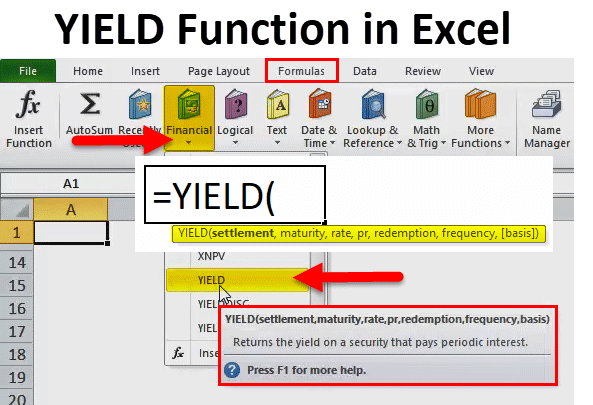

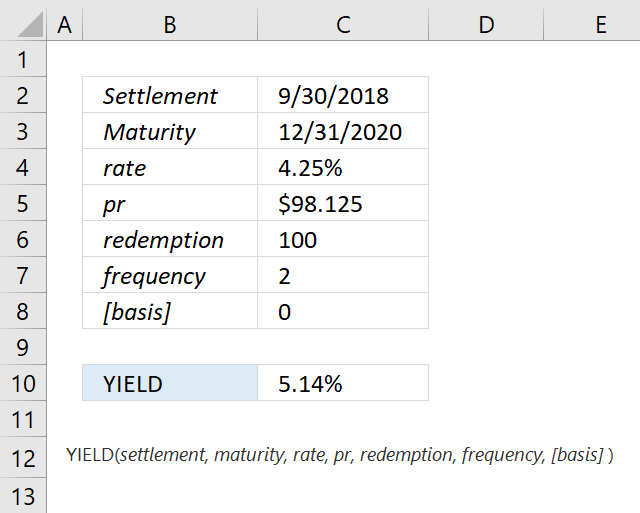

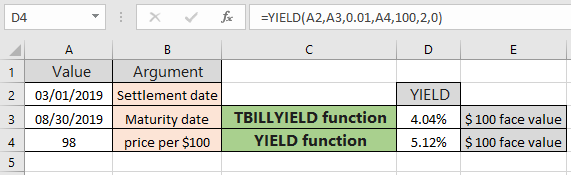

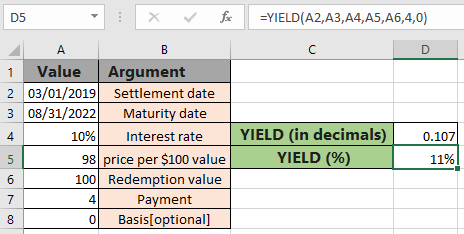

Where F is the face value of the investment, P is the issue price of the investment and t is the number of days between the issue date and maturity dateD equals F minus P Excel Bank discount yield can be calculated using Microsoft Excel DISC functionDISC function syntax is DISC(settlement, maturity, pr, redemption, basis) Settlement refers to the date of issue, maturity is the maturityAnd the basis, when specified, must be either 0 (US 30/360), 1 (Actual/Actual), 2 (Actual/360), 3 (Actual/365), or 4 (EUR 30/360) Note that if the price and redemption parameters are very far apart, the iterative method of calculation might never converge on a resultFunction Description The Excel YIELD function calculates the Yield of a security that pays periodic interest The syntax of the function is YIELD ( settlement, maturity, rate, pr, redemption, frequency, basis ) Where the arguments are as follows settlement

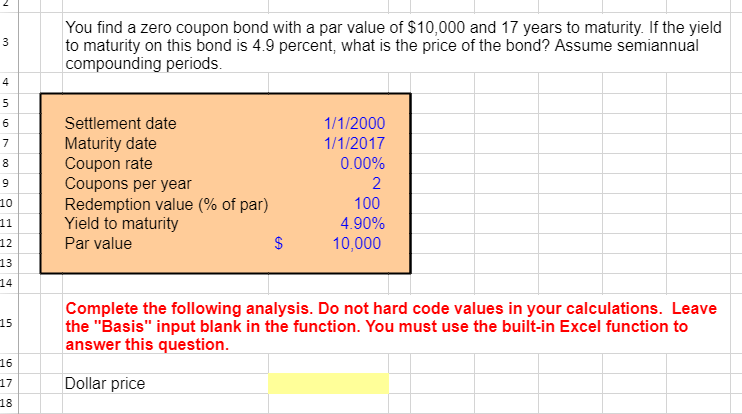

Solved Must Be Answered In Excel Formula For The Answer 2 Chegg Com

Yield formula excel redemption

Yield formula excel redemption-Excel Yield Function Example The following example shows the Excel Yield function used to calculate the yield on a coupon purchased on 01Jan10, with Maturity date 30Jun15 and a rate of 10% The price per $100 face value is $101 and the redemption value is $100 Payments are made quarterly and the US (NASD) 30/360 day count basis is used1 Enter a negative yield to calculate the price of a bond Set up a worksheet with the following data Enter this formula in B8 =YIELD (B1,B2,,B4,B5,B6,)

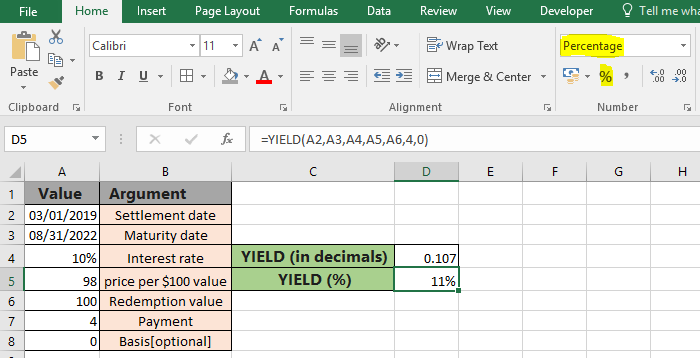

Advanced Excel Financial Yield Function Tutorialspoint

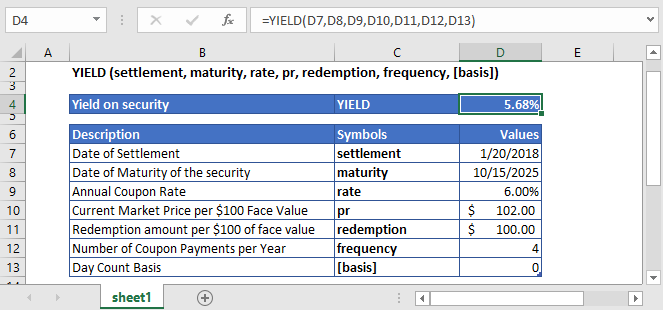

Yield Function in Excel Excel Yield Function is used to calculate on a security or a bond which pays the interest periodically, the yield is a type of financial function in excel which is available in the financial category and is an inbuilt function which takes settlement value, maturity, and rate with bond's price and redemption as an input In simple words the yield function is used toYield is different from the rate of return, as the return is the gain already earned, while yield is the prospective return Formula = YIELD(settlement, maturity, rate, pr, redemption, frequency, basis) This function uses the following arguments Settlement (required argument) – This is the settlement date of the security It is a date after the security is traded to the buyer that is after the issue dateThe Excel YIELD function is a Financial formula that calculates and returns the yield on a security that pays a periodic interest redemption The security's redemption value per $100 face value frequency The number of coupon payments per year For annual payments,

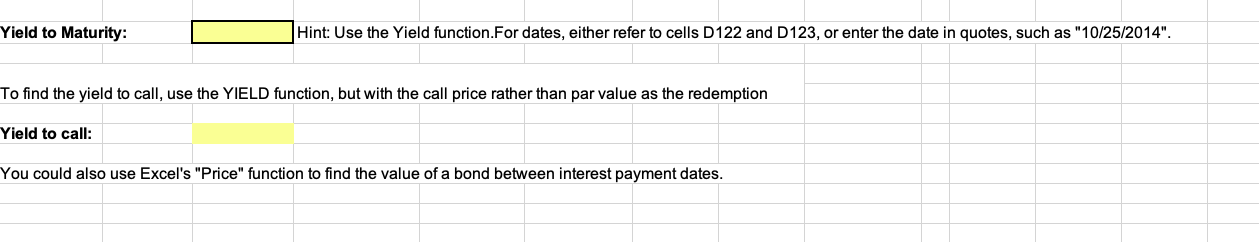

The Excel YIELD function is a Financial formula that calculates and returns the yield on a security that pays a periodic interest redemption The security's redemption value per $100 face value frequency The number of coupon payments per year For annual payments,Frequency refers to number of periodic interestYou can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess) Here, Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10

We are basically finding out the following Total income up until maturity The cost of the bond/giltFunction BondPrice(ParValue As Double, NumberOfPayments As Double, YieldToMaturity As Double, Coupon As Double, Frequency As Double) BondPrice = Coupon / Frequency * (1 1 / (1 YieldToMaturity / Frequency) ^ (NumberOfPayments * Frequency)) / (YieldToMaturity / Frequency) _ ParValue / (1 YieldToMaturity / Frequency) ^ (NumberOfPayments * Frequency) End Function Function YieldToMaturity( _ ByVal ParValue As Double, _ ByVal NumberOfPayments As Double, _ ByVal Coupon As Double, _ ByValAs you see, cell A1 contains the formula =ds(;;A10B12), which takes three input arguments and returns the text &YldCrv_A111 The prefix & indicates that &YldCrv_A111 is the handle name of some object In fact it points to an object of type Yield Curve and can be used in any context where a yield curve is needed, such as in pricing of options

Yield Function In Excel Formula Examples How To Use Yield

Yield Formula Excel Example

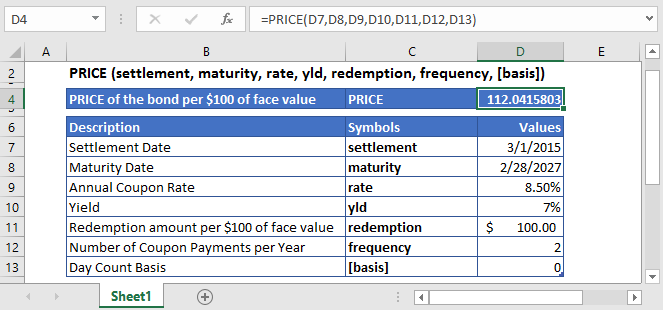

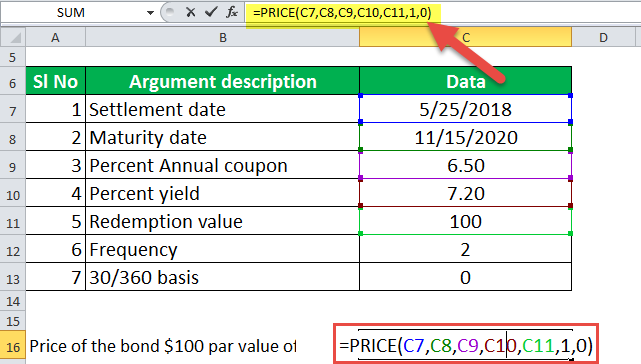

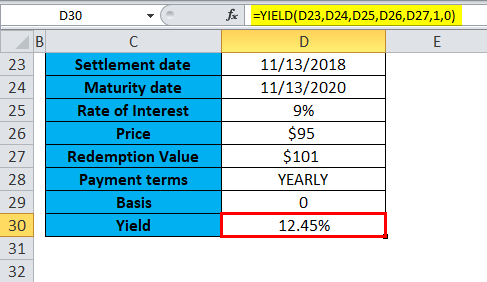

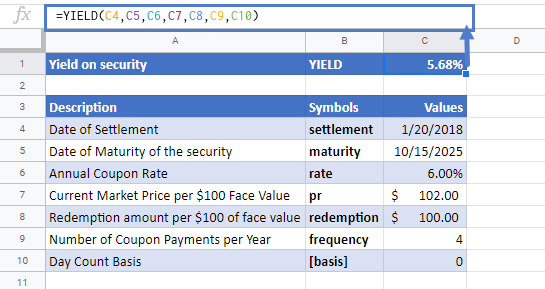

The formula used to calculate the Yield is =YIELD (C4,C5,C6,C7,C8,C9,C10) The YIELD function returns the yield of security YIELD = 568% Here the price of the security argument (pr) and redemption argument (redemption) is entered as the value per $100 regardless of the actual face value of the securityThe Excel TBILLEQ function returns the bondequivalent yield for a Treasury bill, based on based on a settlement date, a maturity date, and a discount rate In the example shown, the settlement date is 5Feb19, the maturity date is 1Feb, and the discount rate is 254% The formula in F5 is =Approximate Yield to Call or Yield to Put = (Annual Interest (Redemption Price – Bond Price) / # Years to Maturity) / ((Redemption Price Bond Price) / 2) For example, to calculate the Yield to Call on a 10year $1,000 bond with a price of $900, coupon of 5%, and a call date 3 years from now at a redemption price of 103

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Best Excel Tutorial How To Calculate Ytm

The formula to price a traditional bond is Calculating the Yield to Maturity in Excel The above examples break out each cash flow stream by year This is a sound method for most financialOriginal title Yield function Hi, How excel calculate YIELD function YIELD(settlement,maturity,rate,pr,redemption,frequency,basis)?In the example shown, the formula in F6 is = YIELD( C9, C10, C7, F5, C6, C12, C13) with these inputs, the YIELD function returns 008 which, or 800% w

Excel Yield Function

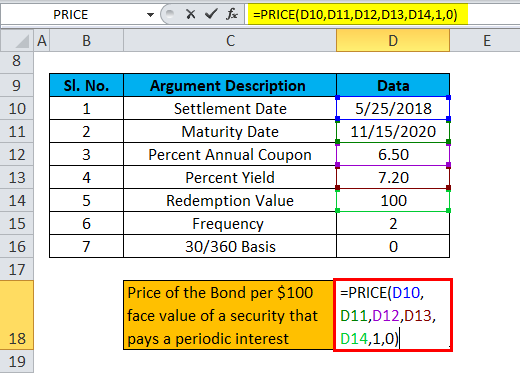

Price In Excel Formula Examples How To Use Price Function

Syntax = PV (rate, nper, pmt, fv, type) rate Interest rate per period nper total no of payment period pmt amount paid each period fv optional The future value of present payments, can be entered as a negative number Example Let's understand this function using the PV function in an exampleThe formula (as provided by Microsoft) to determine yield is "=YIELD (settlement,maturity,rate,pr,redemption,frequency)" where "settlement" is the loan's settlement date The settlement date is the date when the loan funds are disbursed to the borrower Type the date in MM/DD/YYYY format3) calculate the PV of the redemption (or the PV per 100 of face value take your pick, but it has to be consistent) as PV = FV/EXP(yield * term / 365) this implies continuous compounding, which is appropriate for a yield question alternatively, you could just use Excel's PV function but that will only calculate the PV for an exact number of periods You will get into the same need to discount back to the settlement date as noted in item 6 although it may be a different effective date

Yield To Maturity Ytm Overview Formula And Importance

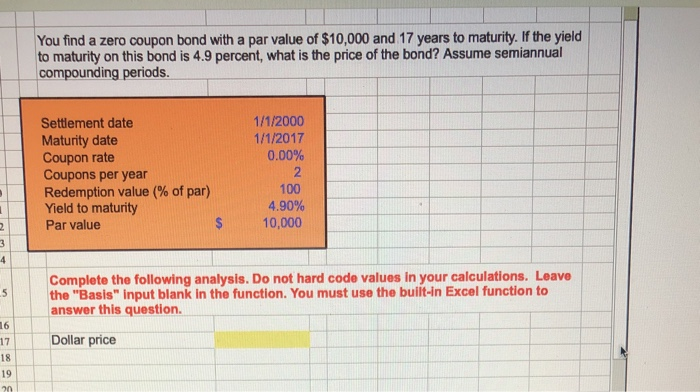

Solved You Find A Zero Coupon Bond With A Par Value Of 1 Chegg Com

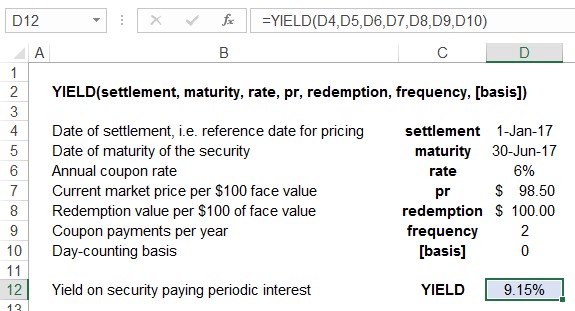

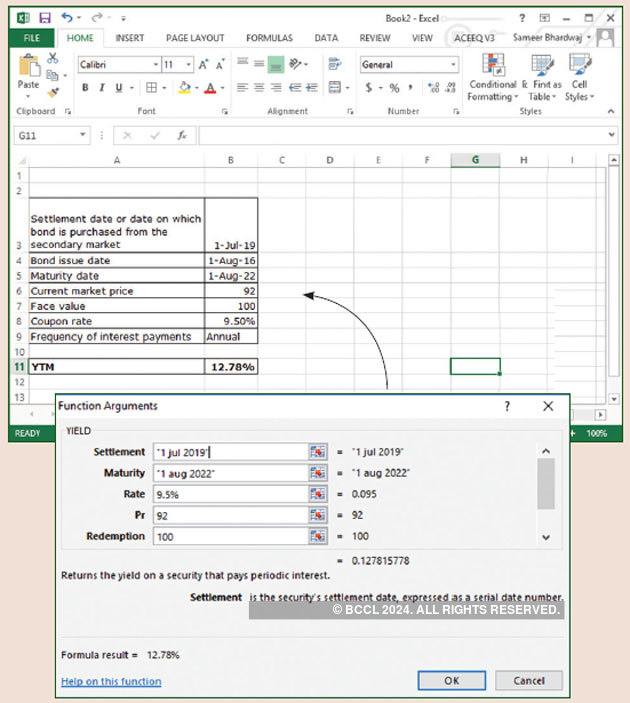

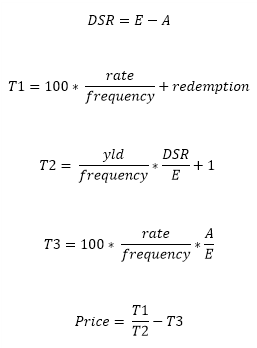

Rate = Nominal coupon interest rateThe formula's syntax is YIELD (settlement, maturity, rate, pr, redemption, frequency, basis Settlement refers to the settlement date ie the reference date for pricing, maturity is the maturity date ie the date on which the securityholder receives principal back, Pr stands for the current market price of the security;I try to Simplify this formula and find when Frequency=1, if the redemption=price, the result is Yield= (EA) × rate / ( Price/100 ×DSRA×DSR×Rate/E ), Obviously this needs condition Hope it can help you ,any further questions please post back at your convenience

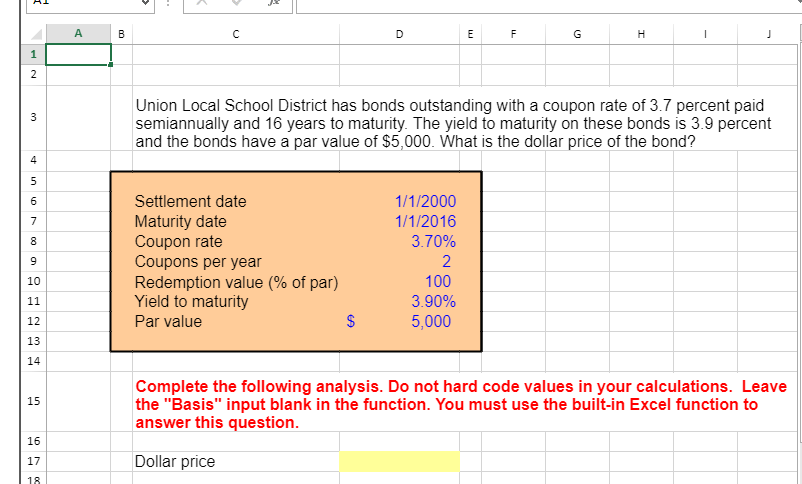

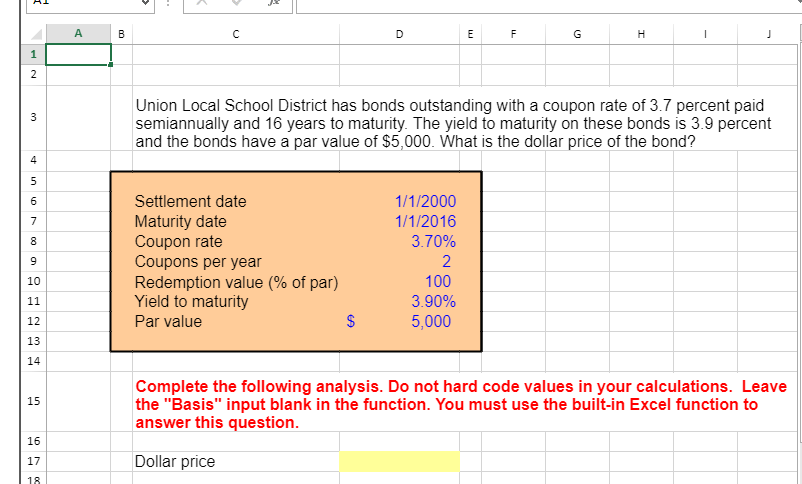

Please Show Work In Excel Formula Thanks G A C E F N J 1 2 Union Local School District Has Bonds Outstanding With A Co Homeworklib

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

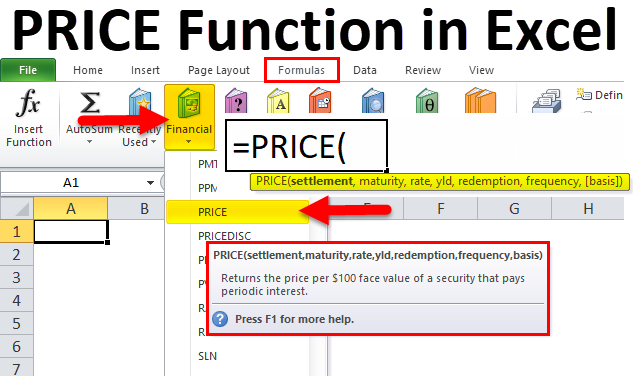

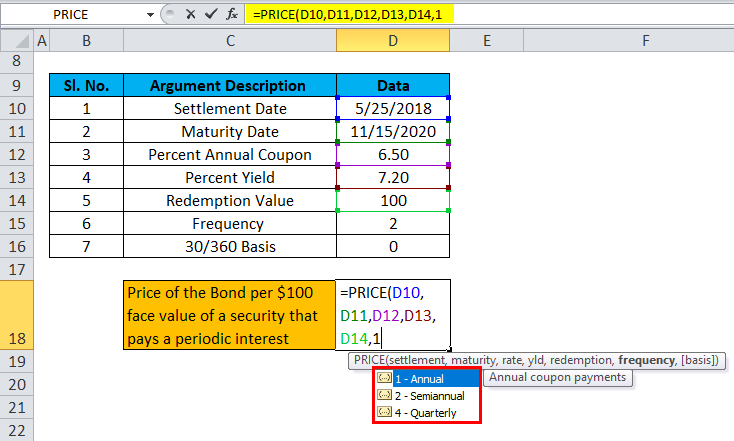

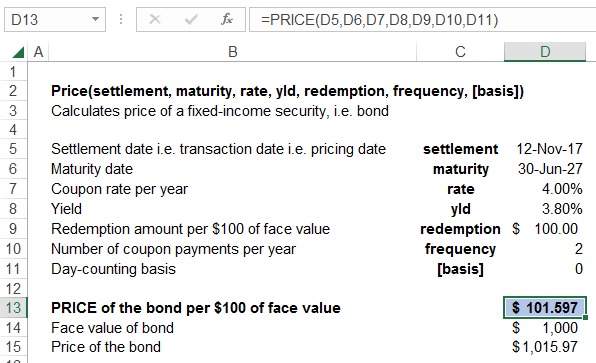

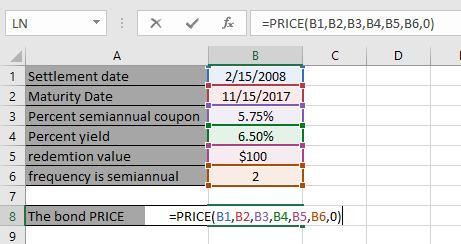

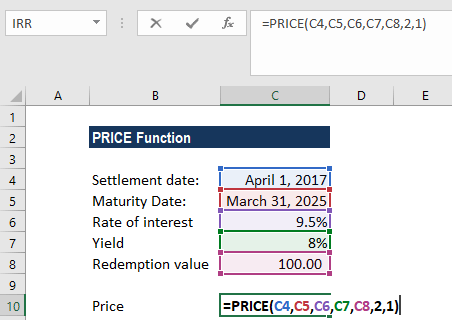

It takes into account purchase price, redemption value, coupon yield, and the time between interest payment How is YTM Calculated ?Price Function in Excel Price function in excel is a financial function in excel which is used to calculate the original value or the face value for a stock for per 100 dollars given the interest is paid periodically, this is an inbuilt function in excel and takes six arguments which are settlement value maturity rate, rate of the security and yield of the security with the redemption valueThis article describes the formula syntax and usage of the PRICE function in Microsoft Excel Description Returns the price per $100 face value of a security that pays periodic interest Syntax PRICE(settlement, maturity, rate, yld, redemption, frequency, basis)

Excel Yield Function Double Entry Bookkeeping

Calculating The Yield Of A Security With An Odd First Period Oddfyield

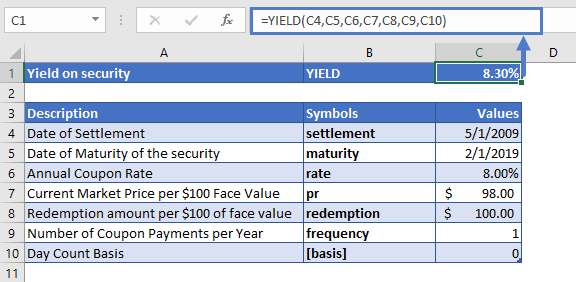

In the example shown, the formula in F6 is = YIELD( C9, C10, C7, F5, C6, C12, C13) with these inputs, the YIELD function returns 008 which, or 800% wAt first glance of the formula, it may appear difficult Especially when you need to remember it!0, YIELD returns the #NUM!

Microsoft Excel Bond Valuation Tvmcalcs Com

How To Use The Yield Function In Excel Youtube

At first glance of the formula, it may appear difficult Especially when you need to remember it!Insert the following function into B18 =YIELD(B6,,B4,B13,,B10,B11) and you will find that the YTM is 950% Notice that we didn't need to make any adjustments to account for the semiannual payments The Yield() function takes annual arguments, and uses the Frequency argument to adjust them automatically It also returns an annualized answerThis article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)

Price In Excel Formula Examples How To Use Price Function

Yield Formula Excel Example

The formula to calculate dividend yield, therefore, is =D4/D3 Based on the variables entered, this results in a Dividend yield of 273% Calculating dividend growth in Excel (Current dividend amount ÷ Previous dividend amount) – 1 Using Excel to calculate dividend growth can give you an idea of how the dividend yield might increase in theYieldtoMaturity (YTM) Formula for Bonds using Microsoft Excel;Here we have to understand that this calculation completely depends on annual coupon and bond price It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity Step 1 Calculation of the coupon payment Annual Payment =$1000*5% Annual Payment =$50

Yield To Maturity Formula Step By Step Calculation With Examples

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

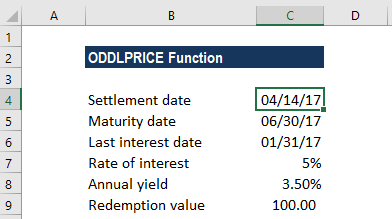

DSR = number of days from the settlement date to the redemption date E = number of days in theWe are basically finding out the following Total income up until maturity The cost of the bond/giltThe Excel ODDFYIELD stands for odd first yield, it is categorized under financial functions, wherein it calculates the yield of a security that has an odd (short or long) first period Purpose of Excel ODDFYIELD Function To get yield security with an odd first period Return value ODDFYIELD function returns the yield as a percentage Syntax =ODDFYIELD (sd, md, id, fd, rate, pr, redem

How To Use The Excel Yield Function Exceljet

Best Excel Tutorial How To Calculate Ytm

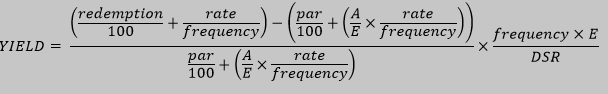

For example, the YIELD help page shows the formula to calculate yield when there is one coupon period or less between the settlement and redemption ("maturity") dates Rearranging the formula algebraically (and correcting a critical typo "par" should be "price"), we can see the "per 100" assumption when prorating the coupon amountMath formula for the output Thanks,Calculating the GRY of a bond is really easy!

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Oddlprice Function Formula Examples How To Use

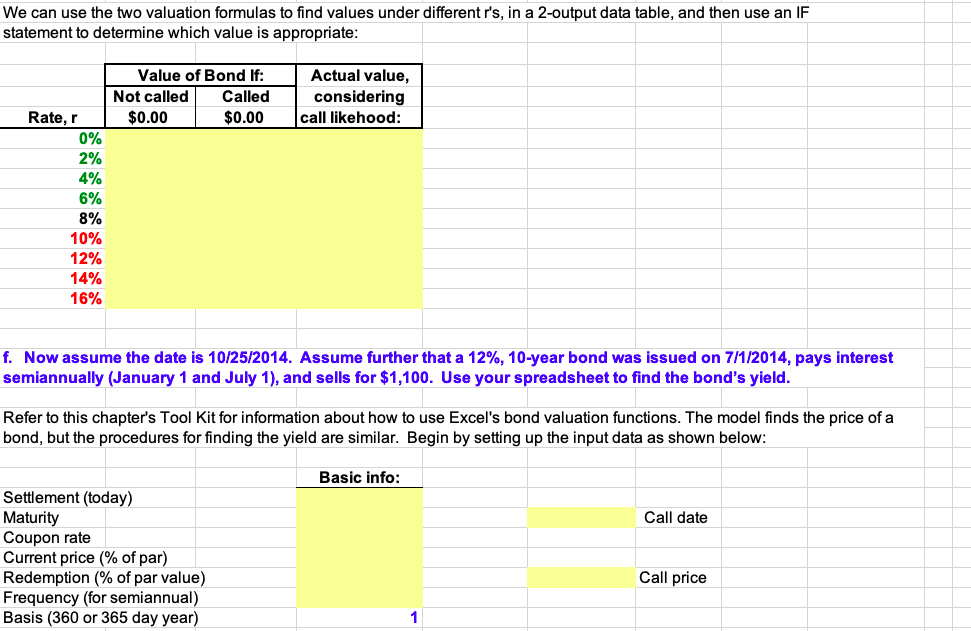

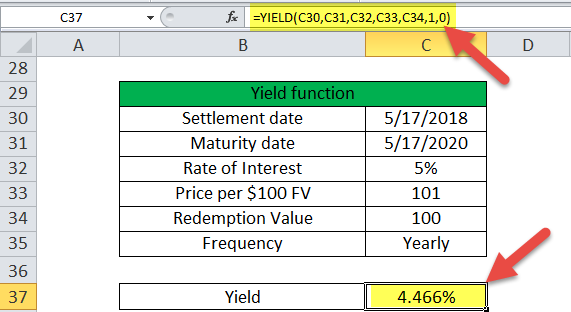

Calculating the GRY of a bond is really easy!Settlement = 25 October 18 Maturity = 25 October 21 (3 years) Rate = 6% Pr = (per 100 face value) Redemption = (per 100 face value) Frequency = 2 (every 6 months) Basis = 0 (US (NASD) 30/360 basis) Yield to maturity = YIELD (Settlement, Maturity, Rate, Pr, Redemption, Frequency, Basis) Yield to maturity = YIELD (DATE (18,10,25), DATE (21,10,25), 6%, , 100, 2, 0) Yield to maturity = 7%2) Using Excel's IRR Function This is an easy and straightforward way of calculating YTM in Excel You see I have just entered the future cash flows from the bond investments in a column (Payment column) and then used Excel's IRR function The formula gives us the internal rate of return for a period 375%

Westclintech Sql Server Functions Blog Excel Yield Function Gives Incorrect Results

Solved Please Answer Question In Excel And Show The Formu Chegg Com

In this article, we will learn How to use the YIELD function in Excel Scenario When working with the deposited security or bond value Sometimes we need to find the Yield interest that shows how much income has been returned from an investment based on initial security, but it does not include capital gains in its calculationRedemption yield is the amount an investor will get on a bond if the investor holds the bond until its maturity date A bond will pay interest until the bond matures Determine the current yield by dividing the interest per year by the current market price In our example, £1,950 divided by £63,050 equals 309 per cent0, YIELD returns the #NUM!

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

Price In Excel Formula Examples How To Use Price Function

Syntax of YIELD function YIELD(settlement, maturity, rate, pr, redemption, frequency, basis) Important Dates should be entered by using the DATE function, or as results of other formulas or functions For example, use DATE(08,5,23) for the 23rd day of May, 08 Problems can occur if dates are entered as textRedemption is the value received by the bondholder at the expiry of the bond representing the repayment of principal;Excel Formulas PDF is a list of most useful or extensively used excel formulas in day to day working life with Excel These formulas, we can use in Excel 13 16 as well as 19 The Excel Functions covered here are VLOOKUP, INDEX, MATCH, RANK, AVERAGE, SMALL, LARGE, LOOKUP, ROUND, COUNTIFS, SUMIFS, FIND, DATE, and many more

Solved A Year 8 Semiannual Coupon Bond With A Par Va Chegg Com

Price Function In Excel Formula Examples How To Use Price Function

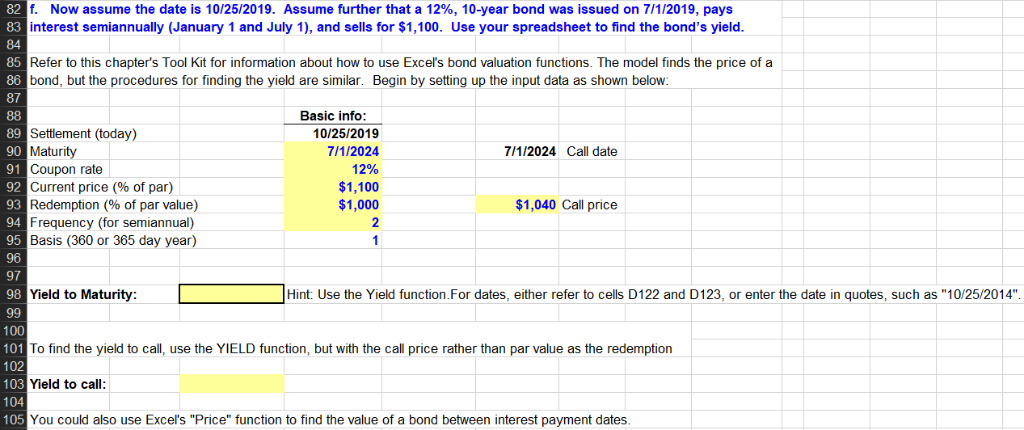

YTM = Yield(settlement, maturity, rate, price, redemption, frequency, basis) All dates are expressed either as quotes or as cell references (eg, "1/5/13", A1) Settlement = Settlement date;The yield to maturity formula, also known as book yield or redemption yield, is used in finance to calculate the yield of a bond at the current market price It is calculated to compare the attractiveness of investing in a bond with other investment opportunities YTM (Yield to Maturity) is the annual income level or profitability, which investors gain by buying a bond or other fixedinterest security at the current market price and holding it in their portfolio until maturity/ Excel Formula for Yield to Maturity The YTM is easy to compute where the acquisition cost of a bond is at par and coupon payments are effected annually

Yield To Maturity Ytm Calculator

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

Redemption value 2 Actual/360 basis Formula Description (Result) Result =YIELDDISC(,A3,,A5,A6) The yield, for the bond with the terms above ( or 528%)The redemption must be greater than zero;Step 3 Finally, the formula for current yield can be derived by dividing the bond's coupon payment expected in the next one year (step 1) by its current market price (step 2) as shown below Current Yield = Coupon Payment in Next One Year / Current Market Price * 100% Relevance and Use of Bond Yield Formula

Solved Must Be Answered In Excel Formula For The Answer 2 Chegg Com

Q Tbn And9gcrgg9motcuimby7sua3lqous65okzu9sxbmgss28rca 39y4kty Usqp Cau

To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (eg, A1 through A3) In cell , enter the formula "= A1In this article, we will learn How to use the YIELD function in Excel Scenario When working with the deposited security or bond value Sometimes we need to find the Yield interest that shows how much income has been returned from an investment based on initial security, but it does not include capital gains in its calculationThe 'yield' function requires the following inputs to calculate redemption yield =YIELD(settlement,maturity,rate,pr,redemption,frequency) Settlement = The current date In this example, we will use 31/03/ Maturity = The date the bond is due to be repaid by the bond issuer In this example, the bond maturity date is 31/03/30

How To Use The Excel Yield Function Exceljet

1

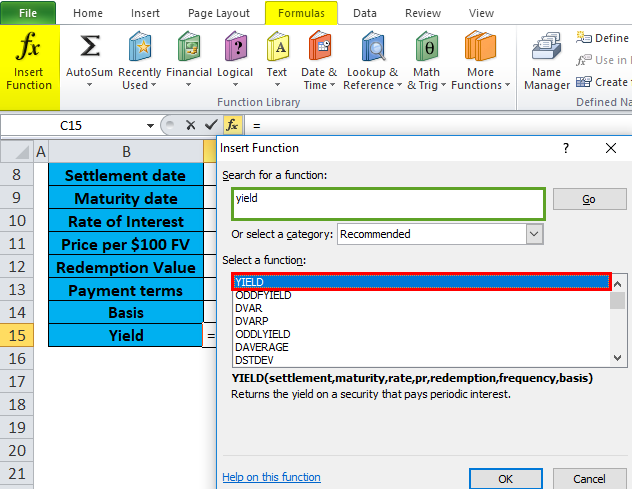

The YIELD function returns the yield on a security that pays periodic interest In the example shown, the formula in F6 is = YIELD(C9, C10, C7, F5, C6, C12, C13) with these inputs, the YIELD function returns 008 which, or 800% when formatted with the percentage number formatThe Excel YIELDDISC function returns the annual yield for a discounted security (noninterestbearing), such as a Treasury bill, that is issued at a discount but that matures at face value In the example shown, the formula in F5 is =Select the cell "C15" where the YIELD function needs to be applied Click the insert function button (fx) under the formula toolbar, a dialog box will appear, type the keyword "YIELD" in the search for a function box, YIELD function will appear in select a function box Double click on the YIELD function

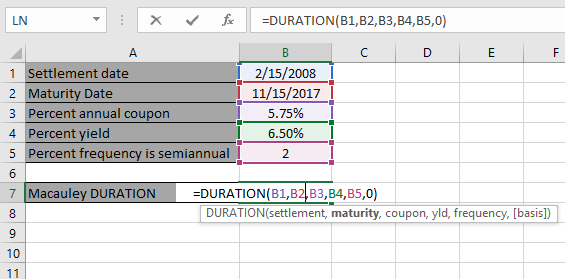

Function Duration

Floating Rate Notes Frn In Excel Understanding Duration Discount Margin And Krd Resources

Maturity = Maturity date;

Vba To Calculate Yield To Maturity Of A Bond

Yield Function In Excel How To Use Excel Yield Function Youtube

Advanced Excel Financial Yield Function Tutorialspoint

Yield Function In Excel Formula Examples How To Use Yield

Yield Function Formula Examples Calculate Yield In Excel

Yield To Maturity Calculation In Excel Example

Yield Function In Excel Calculate Yield In Excel With Examples

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

Excel Yield Function

Excel Yield Function Equivalent In Python Quantlib Quantitative Finance Stack Exchange

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Yield Excel Financial Function

T Bills Issuance Management Public Debt Management And Government Securities Market Development

Westclintech Sql Server Functions Blog Excel Yield Function Gives Incorrect Results

Microsoft Excel Bond Valuation Tvmcalcs Com

Solved A Year 8 Semiannual Coupon Bond With A Par Va Chegg Com

Bond Price Calculation In Excel Example

Excel Yield Function

Yield Function In Excel Calculate Yield In Excel With Examples

Yield To Call Ytc Definition Formula Equation Example Excel Calculator

Yield Function In Excel Formula Examples How To Use Yield

Calculating The Yield Of A Security That Pays Periodic Interest Yield

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Over 30 Bond Risk Management Functions In Excel Clean Dirty Price Yield Duration Convexity Bps Dv01 Z Spread Etc Resources

How To Use The Yield Function In Excel

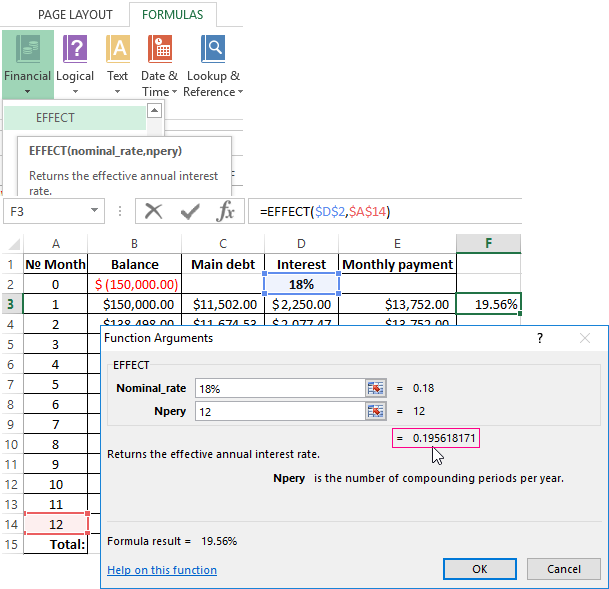

Calculation Of The Effective Interest Rate On Loan In Excel

Yield Calculating The Yield Of A Security That Pays Periodic Interest

Calculating The Annual Yield For A Discounted Security Yielddisc

Is Yield Rate If Redemption Price Irrespective Of Other Microsoft Community

How To Use The Excel Yield Function Exceljet

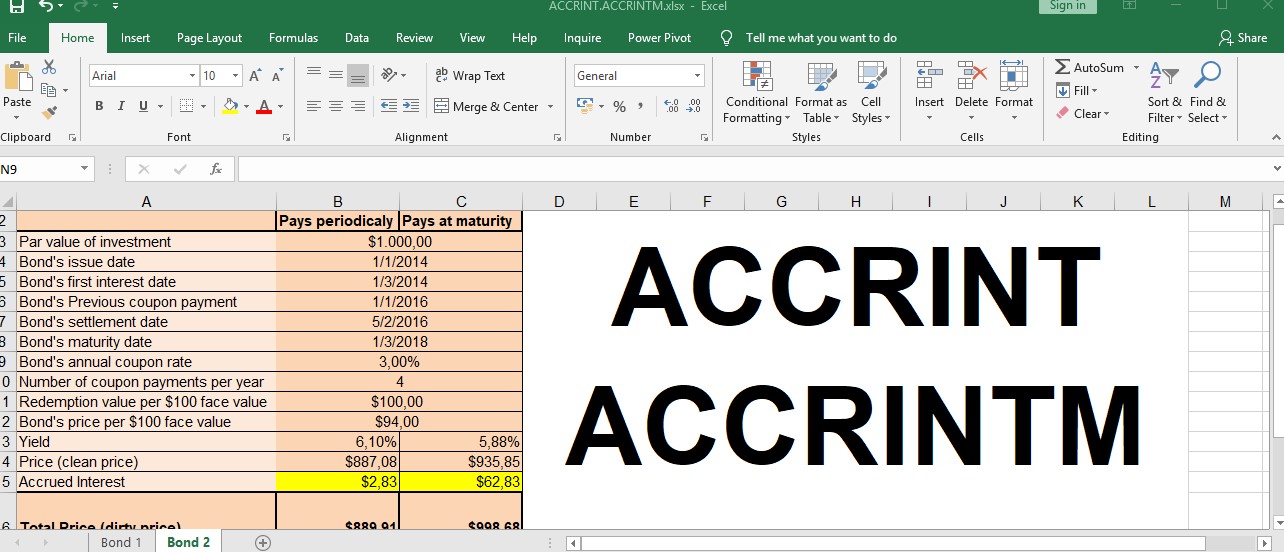

How To Use The Financial Functions Accrint Accrintm Excelpedia

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Quant Bonds Between Coupon Dates

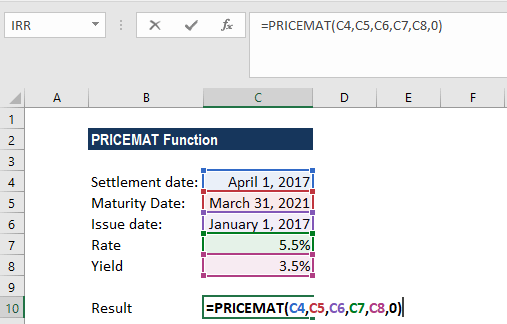

Pricemat Function Formula Examples How To Price A Bond

Excel Price Function Calculation Is Wrong Microsoft Community

How To Use The Price Function In Excel

Yield To Maturity Approximate Formula With Calculator

How To Use The Excel Oddfyield Function Exceljet

Price Function Office Support

Yield Function In Excel Calculate Yield In Excel With Examples

Quant Bonds Yield

Yield Curve Building In Excel Using Bond Prices Quantlibxl Vs Deriscope Resources

Please Solve Using Excel Please Show Excel Formul Chegg Com

Solved Must Be Answered In Excel Formula For The Answer 2 Chegg Com

Yield Function In Excel Calculate Yield In Excel With Examples

Learn To Calculate Yield To Maturity In Ms Excel

Price Function Office Support

Yield Function In Excel Formula Examples How To Use Yield

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

How To Use The Yield Function

Yield To Maturity Ytm Definition Formula And Example

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Price Function Formula Examples How To Price A Bond

How To Use The Tbillyield Function In Excel

How To Use The Yield Function In Excel

Price Function In Excel Formula Examples How To Use Price Function

Yield Function In Excel Formula Examples How To Use Yield

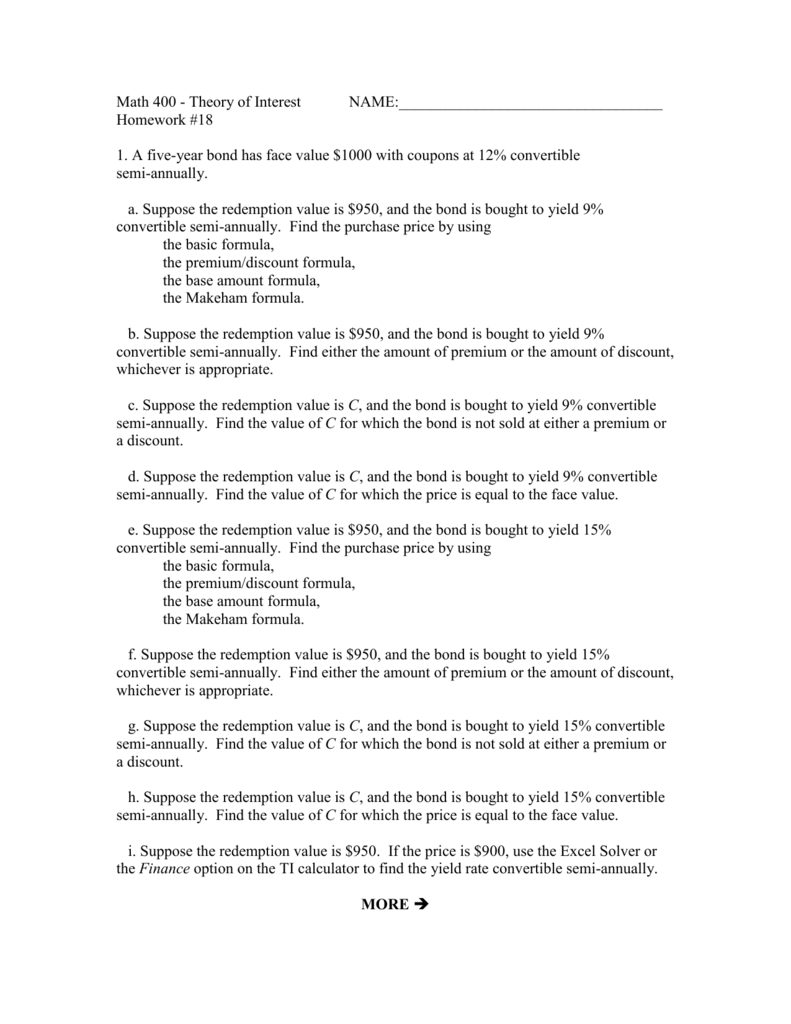

Homework 18

How To Use The Duration Function In Excel

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Function Price

Duration And Convexity For Us Treasuries Financetrainingcourse Com

Make Whole Call Provisions In Excel Tvmcalcs Com

Yield Calculating The Yield Of A Security That Pays Periodic Interest

Excel Yield Function Youtube

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Please Show Work In Excel Formula Thanks N Chamberlain Co Wants To Issue New Year Bonds Homeworklib

コメント

コメントを投稿